On taxable goods manufactured in Malaysia by a taxable person and sold used or disposed by him. The list also provides a comparison of the taxable services and registration thresholds between the old service tax regime and the upcoming regime.

Sst Honda Releases New Prices Up To Rm4 9k Cheaper Paultan Org

Sales and Service Tax SST has replaced the Goods and Sales Tax GST on 1st September 2018 in Malaysia.

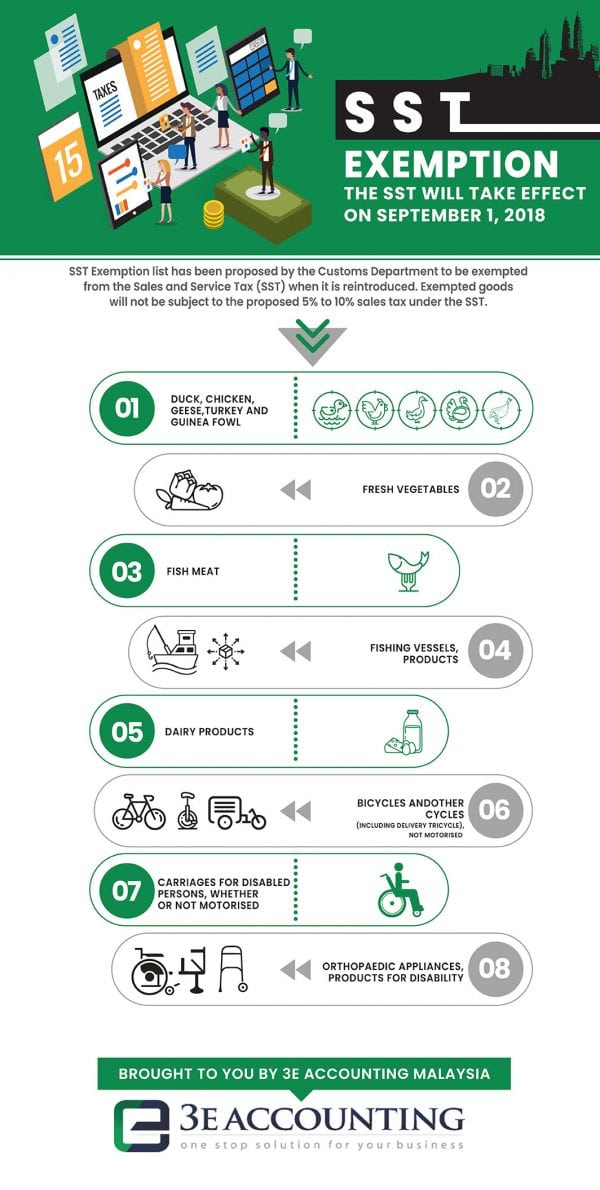

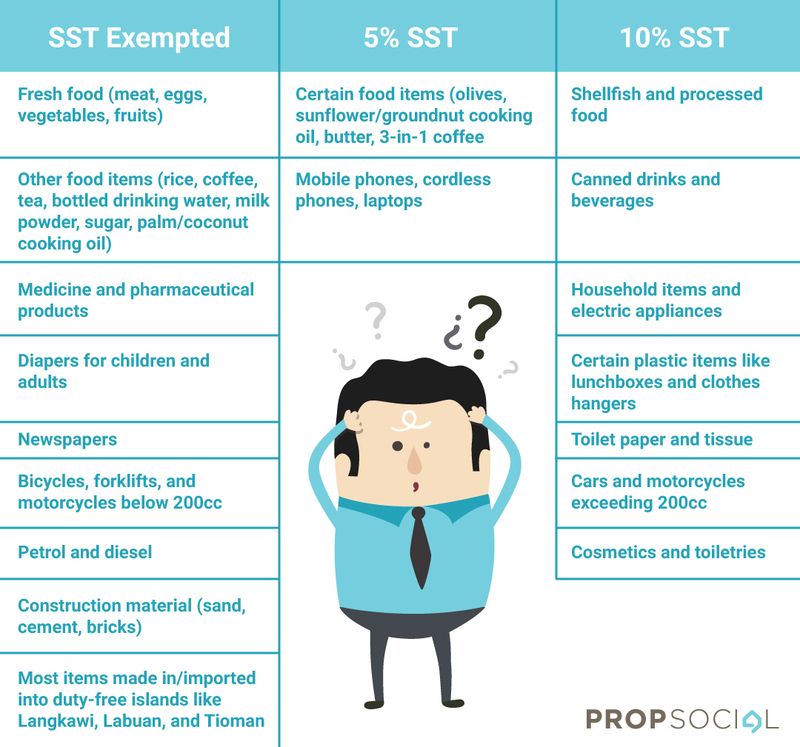

. Exempted Goods Under the new framework food items chemicals pharmaceutical goods medicine iron steel as well as machinery and plant would not be subject to sales tax. The SST-02 return should be submitted on or before the last day of the month that follows the taxable period. It is anticipated that SST will be levied at 10 for goods and 6 for services.

SST MalaysiaSST SeminarSST 2018SST TAXSales and Services TaxSST CustomsSST TrainingSST CourseSST TalkSST ClassSST WorkshopSales Tax ActService Tax ActCukai JualanCukai PerkhidmatanAkta Cukai JualanAkta Cukai PerkhidmatanSST Cu. Companies that registered for the SST should file a report every 2 months and the first taxable period is from September to October 2018. List of Proposed Goods Exempted From Sales Tax Person - Proposed Sales Tax Person Exempted From Sales Tax Order 2018.

People also search for. The SST registration threshold will be the same as GST MYR 500000 sales per annum. However there are some goods exempted from Sales Tax such as.

SST consist of 2 separate act. Taxable goods that are manufactured in or imported into Malaysia by a tax person are subject to sales tax. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan 03-8882 21002300 Ibu Pejabat ccccustomsgovmy.

Sales Tax Act and Service Tax Act. Sales Tax Act 2018 Regulations Sales Tax Regulations 2018 Sales Tax Customs Ruling Regulations 2018. The sales tax is based on exclusion criteria where all things are taxed by default unless being exempted whereas the service tax is based on inclusion criteria meaning.

Live animals fish seafood and certain essential food items including meat milk eggs vegetables fruits bread etc. In this regard Bursa Malaysia Berhad and some of its subsidiaries have been registered for service tax purposes and will start charging 6 service tax on certain fees effective from 1 May 2019. However sales tax is not charged on goods and manufacturing activities exempted by Minister of Finance under Sales Tax Goods Exempted From Tax Order 2018 and Sales Tax Person Exempted From Payment of Tax Order 2018.

SST is administered by the Royal Malaysian Customs Department RMCD. GST was only introduced in April 2015. On the SST Lim said Malaysias 2018 Sales and Services Tax SST collection by the Royal Malaysia Customs Department amounted to RM54 billion which is some 34 higher than the RM4 billion target set during the SSTs implementation on September 1 2018.

Disposed by him and on taxable goods imported into Malaysia. The taxable goods are as follows. Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018.

The complete list can be found on the SST Orders page of the MySST website. Trade SST SST Effective 1 September 2018 the Malaysian Government has replaced the Goods and Services Tax GST with Sales and Service Tax SST. View MGCC_SST_2018_ENpdf from ACC 416 at University of Malaysia Terengganu.

ڤردان منتري مليسيا is the head of government of MalaysiaThe prime minister directs the executive branch of the federal governmentThe Yang di-Pertuan Agong appoints as the prime minister a member of Parliament MP who in his opinion is most likely to command the confidence of a majority of MPs. The Service Tax rate is fixed at 6 and the list of services subject to it include hotels insurance gaming legal and accounting services employment agencies parking couriers advertising and. On 8 August 2018 the Royal Malaysian Customs Department RMCD issued a list of proposed taxable services for service tax purposes.

The Malaysia Service Tax Amendment Regulations for 2019. Sales and Service Tax SST in Malaysia 2018 as of 1st November 2018 1. It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1 June 2018.

Here are the main amendments. Basic foodstuffs medicines some capital equipment and chemicals will be exempted according to a list recently published by the Royal Malaysian Customs Department. The prime minister of Malaysia Malay.

The taxable services are summarised as below. Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline.

Introduction To Sales And Service Tax Sst Quadrant Biz Solutions

Sst Nissan Price List Cheaper By Up To Rm5 400 Paultan Org

Introduction To Sales And Service Tax Sst Quadrant Biz Solutions

Gst Better Than Sst Say Experts

Post Sst Volkswagen Malaysia Reduce Prices For Ckd Models Autobuzz My

Sst Mercedes Benz Price List 19 Models Up 6 Down Paultan Org

Goods And Person Exempted From Sales Tax Sst Malaysia

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Sst Simplified Malaysian Sales Tax Guide Mypf My

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

How Is Malaysia Sst Different From Gst

Sst Simplified Malaysian Sales Tax Guide Mypf My

Welcome Back Sst So What S New Propsocial

![]()

Mercedes Benz Malaysia Announces New Sst Price List While Glc Gets Safety Updates

Motoring Malaysia Sst Prices For Bmw Cars Motorrad Mini In Malaysia Have Been Released Ckd Prices Mostly Goes Down With Cbu Prices Mostly Up

Malaysia Sst Sales And Service Tax A Complete Guide

No 10 Drop In Car Prices Despite 10 Sales Tax Exemption Here S Why Wapcar